TorontoRealtyBlog

If only the actual writers of newspaper articles could pick the headlines, right?

I've mentioned this before, but back when I used to write for The Grid, was quite caught off guard when I learned that I didn't get to pick the titles of my articles. Many of the articles I wrote, I felt, were mischaracterized by the headline itself.

In fact, the very first article I wrote about development in Regent Park came with a headline that I didn't write, and then a level of scorn in the comments section that I never expected.

I think I have a photo of that somewhere….

….ah, here:

And yes, that's exactly what I look like…

Anyways, the point I wanted to make was that this article in the weekend's Globe & Mail came with that sort of "don't do what Donny Don't doesn't do" type of headline:

"The More Affordable Grows Less Affordable As Toronto Condo Rents, Prices Surge"

You have the benefit of reading that with a head's up, but I had to read it twice before I understood it.

Read it ten times, and it's a question of how a person could not read that correctly. But wow, I don't understand how headlines are chosen.

The article itself, however, came with a fantastic look at what's happening with condo rents.

From the article:

The latest report, from the Toronto Real Estate Board, showed "robust average annual rent increases" for condo apartments in the third quarter of the year. Average rent for a one-bedroom unit surged 9.5 per cent to $2,163 from a year earlier, while that for a two-bedroom climbed 8.3 per cent to $2,822.

"Average rents are continuing to increase at annual rates far beyond the rate of inflation in the GTA as rental demand remains very strong relative to the supply of units available," said Jason Mercer, the group's director of market analysis.

"We will need to see a sustained period of time within which growth in the number of rental units listed outstrips growth in the number of units leased before we see the rental market return to balance," he said in the report.

The latest report, from the Toronto Real Estate Board, showed "robust average annual rent increases" for condo apartments in the third quarter of the year. Average rent for a one-bedroom unit surged 9.5 per cent to $2,163 from a year earlier, while that for a two-bedroom climbed 8.3 per cent to $2,822.

"Average rents are continuing to increase at annual rates far beyond the rate of inflation in the GTA as rental demand remains very strong relative to the supply of units available," said Jason Mercer, the group's director of market analysis.

"We will need to see a sustained period of time within which growth in the number of rental units listed outstrips growth in the number of units leased before we see the rental market return to balance," he said in the report.

So rents are up 9.5% and 8.3% respectively for 1-bedroom and 2-bedroom condos, and keep in mind – we're talking about the GTA. If we were talking about Toronto, more specifically, downtown Toronto, I think the numbers might be higher.

These massive increases, which are not in line with inflation, clearly don't scream "rent controls," do they?

In fact, I think we can all admit that the Liberal government's attempts to cool the rental market with their April, 2017 legislation, have failed. Some might argue that the rental increases are because of the legislation, and not merely in spite of it.

Say what you want about the political cause-and-effect, but there's no denying where we stand in Toronto with respect to rents.

Of course, many saw this coming.

A quick Google search provides us with the following:

April 20th, 2017: "Wynne's Rent Control Will Backfire, Says Property Owners Association"

The irony with that particular article was that, in the same article in which property owners were suggesting that rent controls would backfire (which they did), tenants rights groups were clamouring for the rent controls to apply to vacant units as well!

May 6th, 2017: "Wynne's Rent Controls Will Repeat Past Mistakes"

I could go on, but you get the gist of it.

There are plenty of articles from April and May of 2017 suggesting that the rent control legislation was not only misguided, but would have an inverse effect.

Where does that leave us today?

With articles like this:

September 5th, 2018: "Rent Control Is Doing Little To Curb Soaring Rents"

October 4th, 2018: "Ontario's Expanded Rent Control Is Failing Tenants"

And the best part is – one of the contenders for the Mayoral race doesn't even understand the rules surrounding rent controls in Ontario.

Say what you want about Jennifer Keesmat, and defend her if you want to. I won't fight you on it.

But there is no misunderstanding what she said here:

"What Doesn't Keesmat Know About Rent Control"

I personally spoke to two people who were in that room when the questions were being asked and answered, and Ms. Keesmat really, truly did not know that rent controls applied to condos built after 1991.

Anyways, that's not my point. I don't like Keesmat or Tory, for what it's worth…

If you could take the classic "put a face to the name" saying, and apply it to the increase in Toronto rent prices, I think it might help put the increases in closer perspective.

It's one thing to throw around statistics like the 9.5% increase, year-over-year, for the 3rd quarter, for 1-bedroom condos in the GTA.

But it's another thing altogether to see what one particular unit's rent looks like under a microscope.

So for that, I went to MLS, and picked a building at random – 230 King Street East.

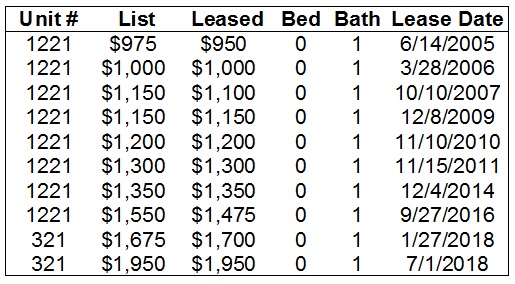

I looked at the history of rents on MLS, trying to find a unit that has been leased over and over, and came up with the following:

That's a bachelor condo, 470 square feet.

First leased in June of 2005 for $950/month.

As you can see, there is a lot of turnover in Toronto, and in March of 2006 (assuming the tenant was leaving, and the landlord put the unit up months in advance), the rent increased a mere $50 per month in absolute terms, but that's a 5.3% increase in relative terms.

The unit went up $100 per month in 2007, then only $50 per month in the next two years – bringing it to $1,100/month in 2009.

Then $50 in 2010, $50 in 2011, only $50 in the three years up to 2014, but then rents went crazy.

A $125 per month increase from 2014 to 2016 – another 4.5% per year.

But that unit hasn't been leased since 2016, so I had to look at other "21" models, and there's only one – Unit #321.

I know what some of you are thinking – perhaps #321 and #1221 are different. But they're not. They're identical 470 square foot models.

The craziness in the rental market dates back about 18 months, and as you can see, this unit went from $1,475 per month in 2016 to $1,700 per month in January of 2018, and then when the tenant left after only six months (who knows what happened here), the landlord took advantage of a barren summer market and got a whopping $1,950/month.

That's a 105.3% increase in 13 years.

But more importantly, a 44.4% increase in less than four years.

What about larger units?

How about a true 1-bedroom, and perhaps with a den?

And what about the other side of the downtown core?

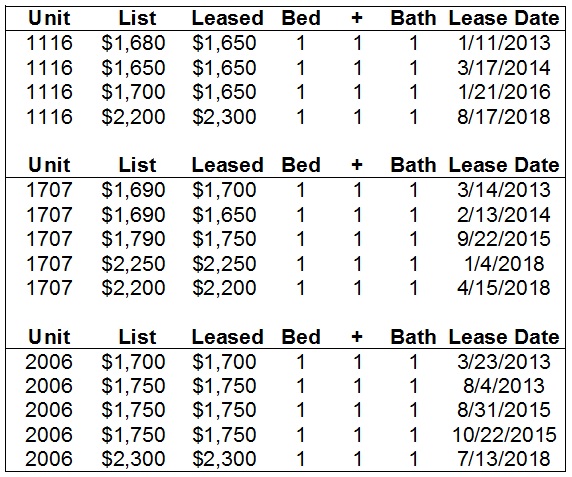

I went to Liberty Village and took a look at 65 East Liberty Street; a pretty standard, 24-storey condo that has a slew of rental units, and was completed in 2013.

I looked at three units this time, (ensuring that I found units that were actually leased in 2018) and here's what I found:

Unit #1116 has increased from $1,650 per month to $2,300 per month. That's an annualized increase of 7.1%

Unit #1707 has increased from $1,700 per month to $2,200 per month. That's an annualized increase of 5.8%.

Unit #2006 has increased from $1,700 per month to $2,300 per month. That's an annualized increase of 6.6%.

What do you make of these numbers?

Overall, they're actually less than the 9.5% figure we were given at the onset, which was for 1-bedroom units, GTA-wide, from the 3rd quarter of 2017 to the same period this year.

But despite the lower figure, I still think a 6.5% yearly increase in rental prices, over the past five years, is shocking.

If the government hopes to keep rent increases in line with inflation, I simply do not see that happening.

Sure, they can mandate a 1% increase in rents for existing tenants. But as you can see from the listings above, turnover is natural in the downtown core. Those units at 65 East Liberty Street have turned over five times in five years. So while the rent increases could keep prices low, in theory, in reality – landlords are given opportunities naturally to increase prices on the free market.

Not only that, consider that every time a new condo unit is finished, that unit's price is set at market rent.

So if a 500 square foot unit at 123 King Street was leasing for $1,500 in 2017, the tenant stayed for two years, and thus the rent was only increased to $1,520 in 2018, and then $1,540 in 2019, a unit completed next door at 125 King Street, and completed in 2019, would be leased anew for $2,000 per month.

Every single new unit will be set at market rent.

And as we can see above, units turnover constantly in the downtown core.

I could go on and give you demonstrations like the above all day long, but I think you get the three major take-aways:

1) Rents were slow to rise from 2005 to 2010.

2) Rents have skyrocketed from 2016 to present.

3) Turnover is natural among Toronto's downtown condos.

Is it any wonder why "investors" keep buying?

And just to finish on a sarcastic note that perhaps the market bears can use – does anybody know where I can get a 1-bedroom condo for investment that's cash flow positive each month?

The post What's Really Happening With Toronto Lease Prices? appeared first on Toronto Realty Blog.

Originated from https://ift.tt/2yTOIop

No comments:

Post a Comment