TorontoRealtyBlog

How about a little cynicism for a Monday?

Is anybody up for a good, old-fashioned rant about the government?

Well, I'm actually not all that fired up, but I did want to share this story as I think it's in the public's best interest to know, and I think people's opinions on the matter will range from "I really don't care," to "This is BS."

I came across several properties for sale last week that were in awful locations – literally backing "onto the tracks." Ordinarily, this wouldn't draw a second look from me, except that they were owned by a cute little crown corporation called "Metrolinx."

Yes, the same Metrolinx that is currently building the Eglinton Crosstown LRT, and who gave us the Presto Card, and the Union-Pearson Express.

But first, and as is often the custom, let me offer you a random story from my childhood that seems incongruous at first, but eventually makes sense…

When I was younger, my family would head out to a Chinese food restaurant called Spadina Garden, what honestly seemed like every Sunday for about ten years. It was on the north side of Dundas, just west of Bay. This was where my love of plain white rice began, and if I ever turn into a giant fatso, I will blame the nice family that owned this restaurant.

After consuming copious amounts of spicy-peanut chicken, we would try to walk off the glutinous feast by taking a stroll over to Yonge & Dundas. We hit up Sam the Record Man just about every time we went for dinner, and to this day, I still don't understand why cassettes were sold in those long, hard-plastic shells. Do any of you remember? I can't find a picture online, but some of you might recall.

We actually felt bad for ditching Sam when HMV moved in two doors down, but it was really flashy, with great marketing, and we were stupid consumers.

I still remember buying R.E.M.'s "Green" on CD. That was a big day.

On the southeast corner of Yonge & Dundas, there was a 3-storey building that was covered in jeans. That's right, jeans. The entire building had jeans glued to the front of it, and there was a sign that said "GOING OUT BUSINESS SALE."

That's not grammatically correct, I know. But the word "for" was in a font that was so microscopic, you basically thought they were going out of business, when in reality, it was just a gimmick.

There was a huge shoe store next door, and a jewelry shop next to that.

The shops looked a a bit seedy, but the whole area was. It was Yonge Street in the late-80's!

Eventually, however, that "Going Out For Business" jeans shop really, truly, did become the "Going Out Of Business" store, and it wasn't by choice.

That was when my father explained to me the concept of expropriation.

I'll save you the explanation, but it sounded to me as though the government came in and stole your land, while throwing you some bread crumbs in the process.

I was a kid. And naive. I'm way more reasonable now.

While I recognize that expropriation is a necessary evil in any city, and there's simply no way to avoid it, I also, unfortunately, think there's massive potential for corruption, and/or extremely unfair practices.

The City of Toronto, it seems, decided that Yonge & Dundas should be Toronto's answer to New York City's Time Square, and I can't say I don't like the result. I mean, I don't frequent the area. There's absolutely nothing for me to do there. But for tourists? And other, more normal, fun, and social Torontonians? Sure! It's a great feature of the city, and none of it would have been possible without the expropriation of that jeans store on the corner.

But what amount did the City of Toronto pay?

How was that amount determined?

And what would that land be worth today?

Last question, and the most obvious: if you were to take the amount that the land is worth today, and subtract the amount that was paid for it back in the 80's or 90's, what rate of return would the original owner have to have achieved in another investment vehicle, to equal the same return that could have been realized if the city never expropriated the land?

I suspect it would be an absolutely unachievable amount. But I have nothing to back this up, other than my gut, the exponential growth of real estate prices (not to mention commercial land in a development boom), and a hearty amount of cynicism toward the process of expropriation.

So where does this leave us?

Oh, right, Metrolinx.

Metrolinx has expropriated many, many properties throughout Southern Ontario to account for their various projects, as is their right.

But recently a few of their properties went up for sale, and the whole thing seems a bit off to me.

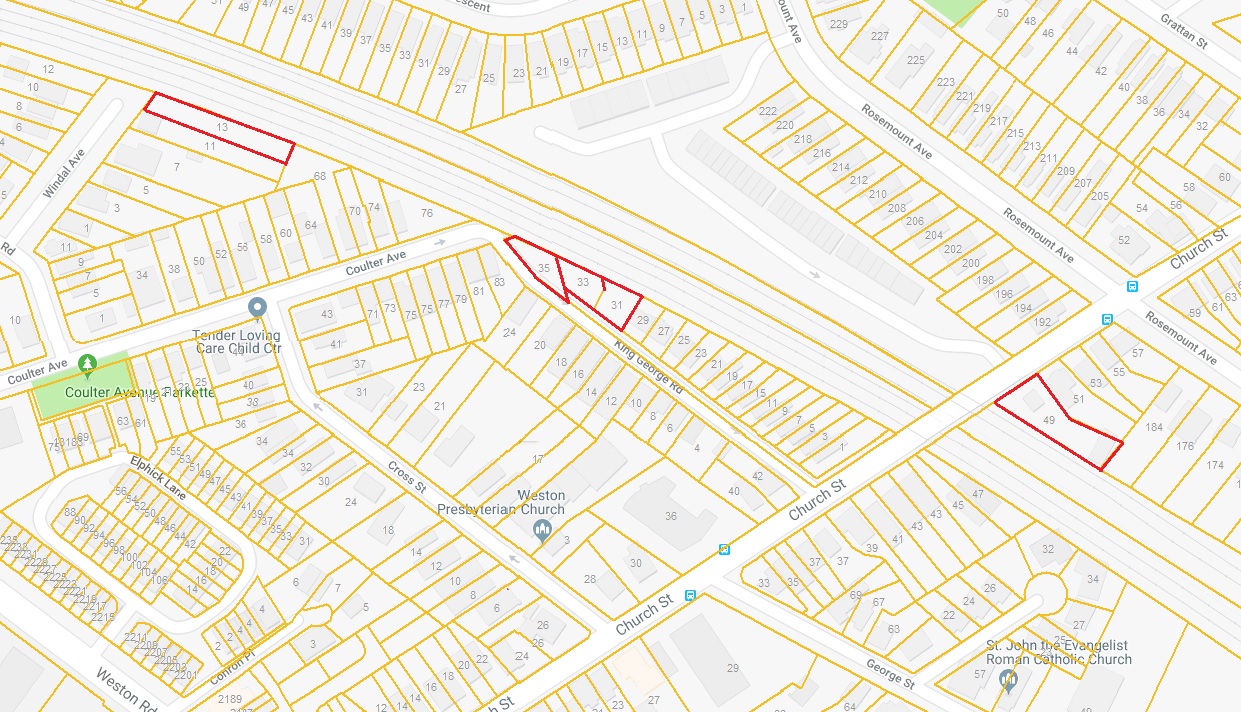

Here's a map of where Metrolinx owns four properties, all of which were recently up for sale:

Now I can't say with absolute certainty that these properties were expropriated, and not happily offered up by the previous owners, but the bottom line is – the crown corporation purchased them, and has held them for the last six or seven years.

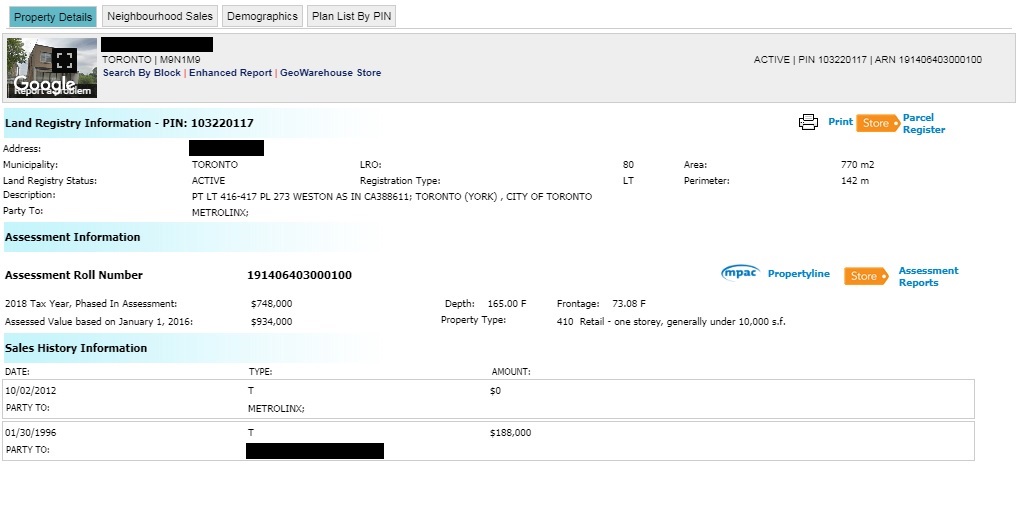

We can't see what Metrolinx paid for the properties, since the sale prices were suppressed. Yes, this is possible, by the way. There is a process you can go through to ensure that the sale of a property does not show up in public record searches. It looks something like this:

I've chosen to black out the address of the property, I don't know why.

"Rules" about what real estate agents can, and can't do with regards to sold data in a public form (outside of a VOW) are still in a grey area, but I digress.

But this isn't any different information than what anybody out there can find through public information, so what the heck.

So here you can see that Metrolinx paid $0 for the property, which closed back in 2012.

Not knowing how much they paid for these properties is a bit frustrating, considering that three of them just sold!

Yes, in between my putting this blog topic in the queue, and actually sitting down to write it, three of the properties were sold.

But that's good news, because it will simply fan the flames. Because these properties sold for a pittance, compared to what Metrolinx likely paid for them.

"Likely." Damn. That's the best that I can do, without the actual sale prices.

But do you see how there's an "assessed value" for that property above? It last sold for $188,000 in 1996, has an assessed value of $748,000 for 2018, and a phased-in value of $934,000? Can we use those numbers to try and gain some insight into Metrolinx' um, er, investments?

Again, I can't give out sold data in a public forum, so let's just run through a hypothetical situation, which might end up being highly accurate…

Property A – sold for $360,000 in 2007, assessment of $271,000, listed for $199,000, sold for $130,000.

Property B – sold for $320,000 in 2008, assessment of $313,000, listed for $199,000, sold for $130,000.

Property C – sold for $304,000 in 2007, assessment of $311,000, listed for $199,000, sold for $140,000.

So my first question is: how come these assessments were so low?

We all know that most properties are assessed for less than they're worth. That's how MPAC works, it would seem they catch more flies with honey, and for the person who just paid $2,000,000 for a new-build, they're less likely to raise a fuss with MPAC if the taxes were raised from the value of the bungalow that sat on the land previously, to, say, $1,500,000.

So I can see how all these assessments could come in lower, but in relation to sale prices from ten years ago? That's odd.

My second question would be why the list prices were so low. I don't know what Metrolinx paid for these properties, and I also don't know if this was an expropriation, or a fair sale, but I have my guesses.

And lastly, it might not be fair for me to comment on the sale prices, but 65% of list? Okay…

So all in all, these properties sold in 2018 for around 40% of what they sold for a decade ago, and for an indeterminate percentage of what Metrolinx paid for them in 2011-2012.

Is there a story here? Or are the numbers so small it doesn't matter?

My readers will often complain about not just the amount of risk that the Canadian Mortgage & Housing Corporation, CMHC, takes on every day, but often the mere existence of the crown corporation to begin with.

So is there anything to be made of Metrolinx losing money on fire sales of (potentially) expropriated properties that they didn't end up needing?

Chew on that with your Monday morning coffee…

The post Does Metrolinx Sell Real Estate? appeared first on Toronto Realty Blog.

Originated from https://ift.tt/2Aa7Yjx

No comments:

Post a Comment